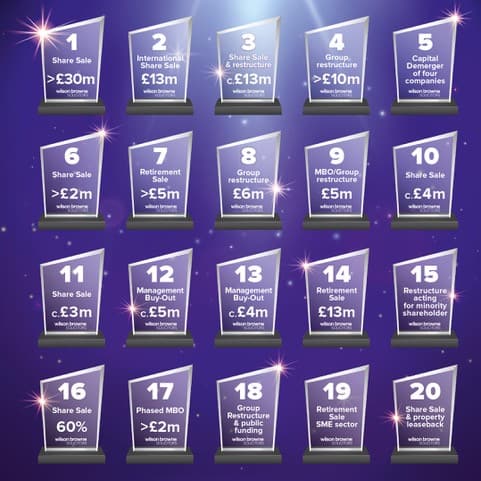

Latest Deals From The Wilson Browne Solicitors Corporate & Commercial Team

The details behind the deals.

1. Construction Industry

What we did: we acted in the share sale of a group of companies which provide end to end services regarding tender, design and installation of utility networks for housing developers. We negotiated the Share Purchase Agreement, Disclosures and property and employment aspects of the transaction.

2. Cosmetics

What we did: we acted for the sellers on an international acquisition by a French-based company of a UK target. There were tight timescales in the transaction and complex due diligence and contracts to accommodate the foreign buyer. We also dealt with specific and complex disclosures pertaining to intellectual property.

3. Construction Industry

What we did: we acted for multiple inter-generational sellers in the demerger of their group to separate three distinct aspects of their business: (a) building merchants;

(b) garden centre; and (c) property investment. We subsequently acted on the sale of the building merchants in a multi-million pound share sale.

4. Construction Industry

What we did: we acted for the holding company in the group restructure of four existing companies and three new companies which we incorporated to effect the transaction. The transaction included a share for share exchange, new articles of association, a capital reduction demerger, distribution in specie and transfer of several properties. The main trading company was subsequently sold for circa £11m.

5. Veterinary Services

What we did: we acted for a corporate group of four companies in a capital reduction demerger. The restructure included the incorporation of four new companies in order to separate the trade. We prepared the documents for a share transfer with deferred consideration with conditional payment dates, a share for share exchange, share allotment and class right variation, a dividend in specie of property, property transfer and two capital reduction demergers. There was also security documents negotiated as a part of the transaction.

6. Construction Industry

What we did: we acted for multiple sellers on a share sale. The transaction included deferred consideration, a completion accounts adjustment based on the financial position of the target as at completion, security and retention provisions all of which were negotiated by our corporate team.

7. Automatic Testing Industry

What we did: We acted in a retirement sale for multiple sellers in this multi-million pound transaction. The sale was to an international buyer and included a purchase price adjustment based on the company’s financial position as at completion but also an earn-out provision based on company performance. Our property team also negotiated new leases and we attended to complexities surrounding a loan repayment as a part of the transaction.

8. Manufacturing Industry

What we did: We acted for a holding company in the restructure of a group of companies within the manufacturing sector. This was in preparation for a subsequent trade sale and included incorporating several new companies, extracting the property and trade and grant of new leases to a trading entity.

9. Engineering Industry

What we did: We acted for the holding company in a complex corporate restructure of an engineering group, which included a partial management buy-out (MBO). This involved setting up multiple new companies, extracting the property and demerger of the existing trading business. We also issued loan notes and security for deferred consideration and worked alongside our property team on granting new leases to the trading entity.

10. Compliance Testing

What we did: we acted for the sellers in the sale of the entire issued share capital of a supplier of compliance testing services to a national group. The transaction included initial consideration plus earn-out based deferred consideration.

11. Product Distribution

What we did: We acted for the sellers in the sale of the entire share capital of their company being a specialist distributor of flooring products to a PLC buyer.

The transaction included initial consideration as well as revenue linked earn-out deferred consideration. Our commercial property team also negotiated

new-leases with the purchaser.

12. Warehousing and Distribution

What we did: we acted on a management buy-out (MBO) of a warehousing group. The transaction included drafting and negotiating the share purchase documents, which included initial and deferred consideration based on profitability of the group.

13. Civil Engineering Sector

What we did: we acted on a management buy-out (MBO) for a supplier of civil engineering services. The transaction included drafting and negotiating the share purchase documents including initial and deferred consideration.

14. Garden and Retail

What we did: we acted for the sellers in a retirement sale – working towards tight timescales in negotiating the share purchase agreement and disclosure documents. The transaction was structured to accommodate the buyer’s funding requirements and involved the collaboration of both our corporate and property teams.

15. Logistics

What we did: we acted for a minority shareholder and advised of his rights and obligations during a complex group restructure. Due to the history of the target concerned, this involved reviewing multiple layers of previous restructures and group transactions.

16. Design and Manufacturing

What we did: we acted in the sale of 60% of a private company’s share capital – this involves more complexities than an entire share sale as not only did we negotiate the share sale documents with initial and deferred consideration on a secured basis but also new Articles of Association and a Shareholders Agreement.

17. Logistics

What we did: we acted for the outgoing shareholders in concluding the third phase of a Management Buy-Out (MBO). This particular transaction included complex funding and fi nancial arrangements to accommodate deferred consideration.

18. Agricultural Technology

What we did: we acted for multiple shareholders in the restructure of a cutting-edge eco-friendly company supporting provision of water in third world countries. The restructure included accommodating rounds of fundraising to support the venture.

19. Engineering Industry

What we did: We acted on a retirement sale for multiple sellers including both an initial payment and an earn-out provision based on target performance.

20. Printing Industry

What we did: we acted for the sale of two companies, one of which was the trading company one of which had the intellectual property used by the target vested in it – each of which was owned by different sellers. The transaction included a new lease, licence and under lease, deferred consideration, settlement agreements and liaising with multiple accountants.