Growing Your Business Using Mergers & Acquisitions

Reasons to choose Wilson Browne

- Direct Access To Your Legal Team

- Recognised by Legal 500

- Northamptonshire Law Society Winners 6 of 8 Previous Years

- Transparent Costs

- Free Initial Consultation

There are many ways that you may look to grow your business.

Some pursue ‘organic growth’ opportunities, focusing on winning tenders, expanding the premises and workforce and increasing the capacity for turnover. However, this is often a slow process. Another means of acquisition is to go with direct acquisitions or mergers of complementary and similar businesses, which can result in more rapid growth.

When it comes to buying, selling or disposing of a business, we understand that some clients are well-versed in the legal issues involved – for others, speaking with us may be the first time that specialist advice has been sought. At Wilson Browne Solicitors, our award-winning team have advised numerous clients in connection with business sales and purchases, allowing you to count on our expert advice no matter what your situation.

We work with our clients and alongside accountants and financiers to identify risks and assist in finding the right solution, all whilst continually striving to keep matters on budget and on track. We have a reputation for giving sound legal advice whilst remaining approachable and pragmatic. With offices across Northamptonshire and Leicestershire, our mergers and acquisitions solicitors have a wealth of experience from advising companies on a wide range of business acquisitions and disposals across a wide range of business sectors.

What is an acquisition?

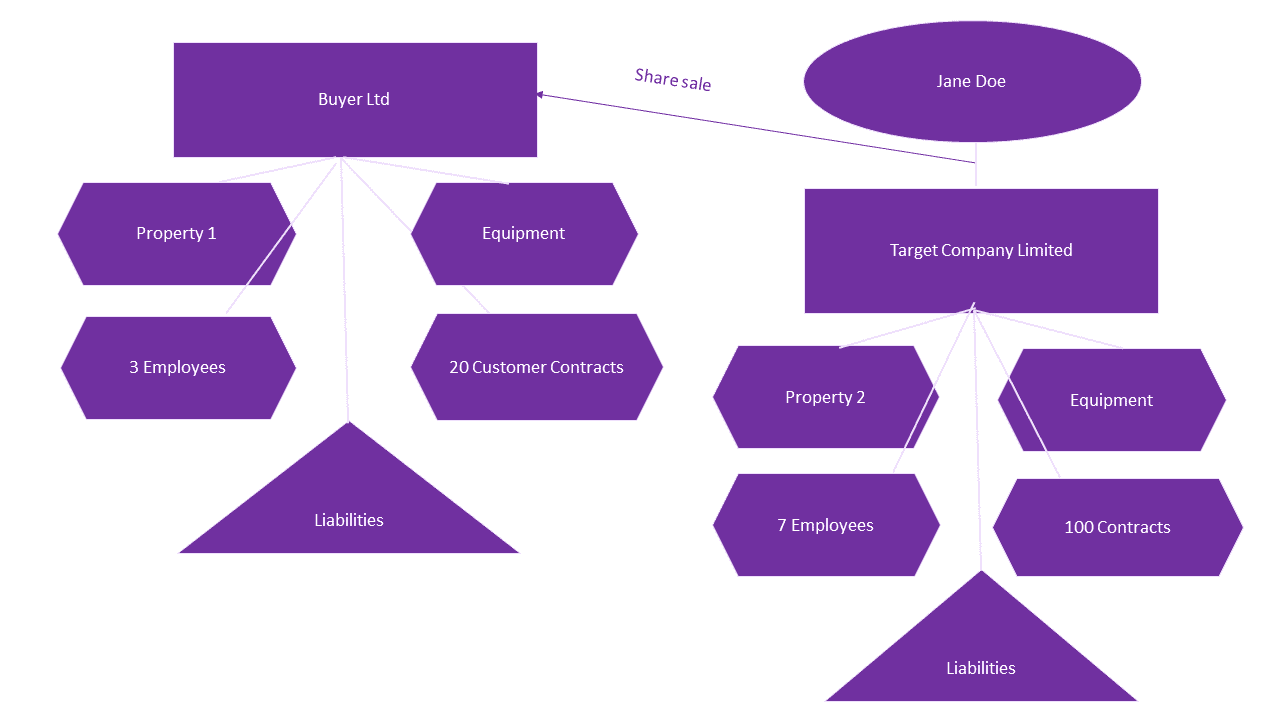

An acquisition is where one business acquires the business of another. This typically can take two forms, either as a share purchase or an asset purchase.

A Share Purchase is where you acquire the entire share capital of another company- that company then retains all of its trade, assets and business. In a growth/acquisition strategy, this can result in the formation of a group as the target company becomes the subsidiary of the buyer. However, it retains all of its assets and liabilities.

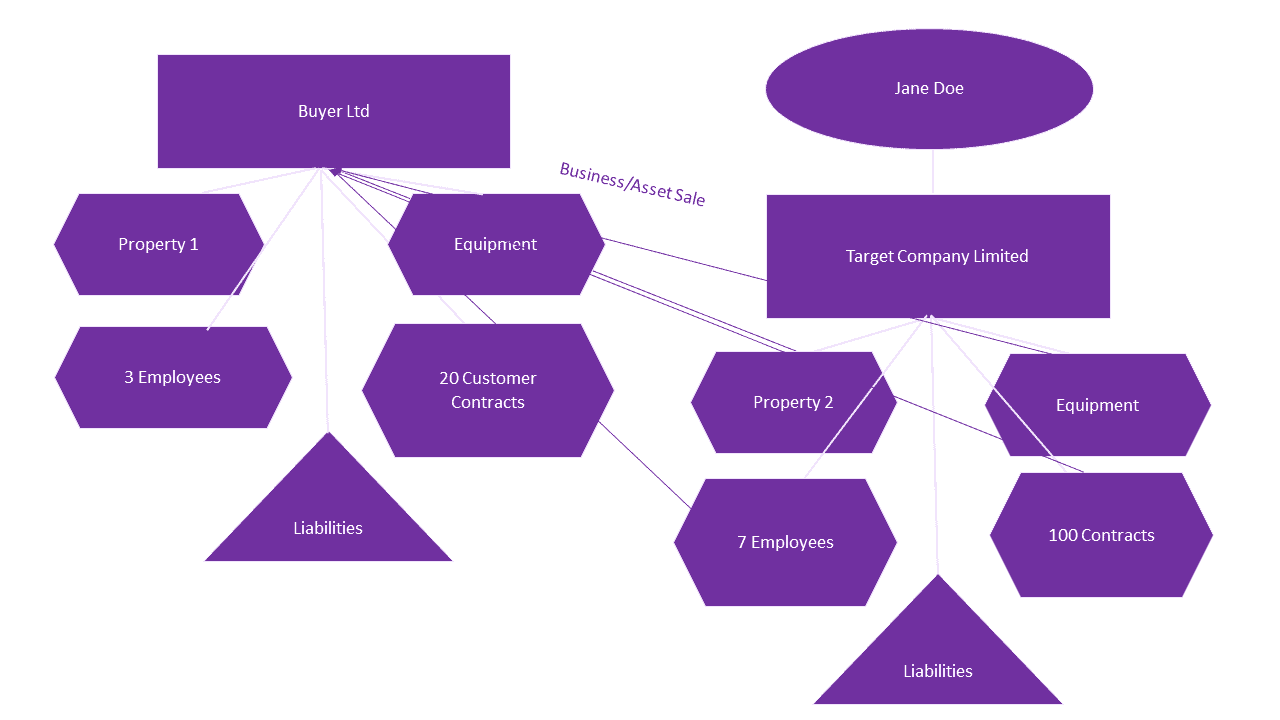

In contrast, a business sale or asset acquisition is where rather than buying the entire share capital of a company, the acquiring company acquires either select assets or all of the assets which comprise the business.

(Difficulty seeing the above diagrams? Click here)

(Difficulty seeing the above diagrams? Click here)

Which is better – a share purchase or an asset purchase?

Doing a share acquisition can have the benefit of maintaining continuity of business – the business of the company continues to operate as it always has with all customers, terms and conditions, employees, property etc. all staying in place. However, it does run the risk of the liabilities which also remain in place – which is why due diligence is crucial. You also need extensive warranties and indemnities in the contract to deal with any undisclosed/unexpected liabilities – particularly when it comes to tax as you will inherit a company’s historic tax position.

Doing an asset acquisition can be more disruptive to the business, you need to ensure that all assets are transferred, contracts assigned, property is transferred and employees also transferred in accordance with the relevant legislation (commonly referred to as a TUPE transfer). However, it does mean that you can ‘cherry pick’ certain assets, e.g. if you don’t need certain equipment or physical premises, you could ‘leave’ these behind if the seller is agreed to selling on this basis. It also means that liabilities are left behind so you run a lower risk from this perspective. However, due diligence is still important to ensure you acquire everything you need to run the business.

Ultimately, which is the right route will depend on a buyer’s risk appetite as well as the commercial intentions of the buyer and needs of the transaction.

What is a merger?

Although commonly grouped together under the term ‘mergers and acquisitions’ or ‘M&A’, a merger is different from an acquisition in that it’s a consolidation of two businesses. It is not the case of one business simply expanding its reach and empire, but the two businesses coming together to form one business. This can have various structures, the first stage of which may be an acquisition by one of another but with the ‘selling’ shareholder acquiring shares in the buyer also. It may also involve moving assets around in the group after the acquisition so that they are all vested in the same company. It could also involve forming a holding company, which then acquires shares in both of the companies to form a group structure.

The key thing with a merger is getting the right structure for the business and ensuring that it is reflective of how the business wants to operate post-completion. The commercial structure shouldn’t be considered in isolation and the legal structure and tax implications should also be carefully considered; clearance from HMRC may be required to ensure there are no inadvertent unexpected tax consequences for your chosen structure.

In addition, just as with an acquisition model you will need to do due diligence. But this time, as it’s a merger you can also expect the other merging business to ask the same questions and undertake due diligence on you!

Why would you undertake an acquisition or merger?

As mentioned, an acquisition or merger can be a rapid way of expanding your business. You can get equipment, more staff, additional premises and key customers through undertaking an acquisition or merger. You get enhanced exposure and instant access to an expanded business. That is not to say it doesn’t take time, it can take several months to find and acquire the right target, but it is a different process and can be more rapid than organic growth. One common example is for a company to acquire one of its distribution arms so that it gets direct benefits rather than just the income from any distribution agreement in place.

It may be that you want not only to expand the business, but expand your service offering or bring an aspect of your business ‘in-house’. Doing and acquisition or merger can allow you to acquire particular expertise that enhances your existing business. For example, if you’re a construction company that is frequently hiring cranes, you may look to acquire a crane-business so that you can not only service your existing projects yourself but also offer this as a service offering to others within the business/customers.

What are the cons of doing an acquisition or merger?

There are always going to be risks involved in a transaction, and whilst mitigated by due diligence, indemnities and warranties they cannot be eliminated in their entirety.

Undertaking a transaction can be unsettling for a business, particularly in ‘asset only’ or ‘business’ acquisitions. Not only do you need to make sure everything is legally ‘tied up’, but commercially you need to ensure that there is a smooth transaction and synergy between the two businesses. Workplace culture is a particularly crucial factor and you want to ensure that the values and cultures of the two entities are aligned otherwise you risk a failed transition and fractured business post-completion. Organic growth is a softer approach and can ensure your culture prevails as a natural expansion of what the business is doing and inherent growth.

Funding is also going to play a key factor, to do an acquisition can be a direct upfront cost. That is not only the cost to do the purchase, but also there are commonly taxes due and legal and professional fees which will need to be budgeted. This may come from existing resources, with profits being used to grow the business rather than paid to shareholders, or may come from third party funding which is likely to involve leveraging assets and increasing debt. Therefore, choosing the right target and making sure that you get it right is crucial. Otherwise, you could face a significant financial outlay without the long-term benefits that should come with the transaction.

Why do I need a lawyer?

When you’re looking to expand your business using a merger or acquisition, it is a high risk transaction. There are several aspects that your solicitor will be engaged in, including:

- Due Diligence – regardless of the structure due diligence will need to be undertaken. This goes beyond commercial due diligence which relates to how the business operates, but goes to understanding the legal structure of the entities involved, underpinning contractual relationships each entity has, compliance with relevant laws and impact that the transaction could legally have – for example withdrawal of financial facilities.

- Contracts – each option will need to have contractually binding documents which effect the transaction and move you from the current structure to the new structure. This may include a share purchase agreement or business sale agreement, board minutes and resolutions, formal notices and waivers, assignments of contracts, property transfers, Companies House returns, powers of attorney and indemnities. Your solicitor will need to prepare and negotiate these on your behalf, ensuring that they work to your best interests and mitigate risks in the transaction. What you need ultimately will depend on the deal structure.

- Disclosures – in any transaction it is common that a seller will need to make formal ‘disclosures’ to notify a buyer of matters which are incompatible with the warranties sought. This is usually in the form of a Disclosure Letter and your solicitor will need to review and advise you on this in the context of the transaction. In a merger, you may also require one of these yourselves and your solicitor will help you prepare one to mitigate your exposure to warranty claims.

These are just a few examples of the support your solicitor will give. They will most-likely consult with you throughout the process, discuss various options, work with your other professional advisors, comment on the tax clearance from a legal perspective, produce heads of terms, advise on funding and security documents required and assist with post-completion matters such as aligning contracts, dealing any staff restructures resulting from the deal as well as moving assets within the group if needed. When choosing a solicitor, you need to ensure that you engage with a firm that has the required rounded business expertise to support each aspect of your transaction, understands the industry and any idiosyncrasies that you need to consider, and that can work with you and your other professional advisors to take a commercial approach, understanding the bigger picture and your ultimate goals.

The Company and Commercial, Employment, and Commercial Property teams at Wilson Browne Solicitors are ideally placed to advise and assist with any acquisitions or mergers that you may be considering. We work together and with your other professional advisors ensuring that you have all of the help you need for your transaction.

(Difficulty seeing the above diagrams?

(Difficulty seeing the above diagrams?